Get the free dl 400d

Show details

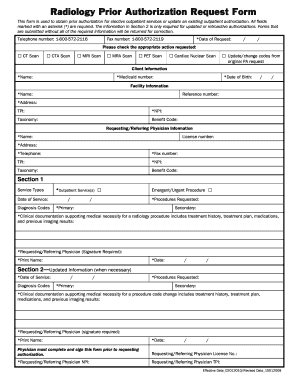

This document is used by driving schools in California to log the issuance of various types of certificates for students, ensuring accountability and record-keeping in accordance with state regulations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dl 400d certificate form

Edit your dl400d form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dl for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit dl 400c certificate online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit dl 400d form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dl 400d form

How to fill out ol 214?

01

Start by obtaining the ol 214 form from the appropriate authority.

02

Carefully read and understand the instructions provided with the form.

03

Begin by filling out the personal information section, including your full name, address, and contact details.

04

Provide any required identification or reference numbers as specified in the form.

05

Enter the necessary details related to the purpose of the form, such as the specific event or transaction it pertains to.

06

Complete any additional sections or fields required by the form, such as indicating your preferences or providing supporting documentation.

07

Review the completed form and ensure all information is accurate and legible.

08

Sign and date the form as required.

09

Submit the filled-out ol 214 form to the appropriate authority as instructed.

Who needs ol 214?

01

Individuals who are participating in a specific event or transaction that requires the completion of ol 214 may need it.

02

Certain organizations or institutions may also require individuals to fill out ol 214 for administrative purposes.

03

The specific need for ol 214 will depend on the context and requirements set by the authority requesting it.

Fill

form

: Try Risk Free

People Also Ask about

What do I need to get a replacement ID card in California?

proof of identity, 2.) social security number (SSN), and 3.) two proofs of California residency. If your replacement will not be a REAL ID, you do not need to provide any proof documents.

How to start an auto registration tags & titles business in California?

How to Open a DMV Business Opening a DMV Business. Create Your Business Structure and Acquire Capital. Draft all necessary business documents and acquire capital. Submit an Application and Applicable Fees. Submit to a Criminal Background Check. Submit Notary Bonds for all Employees. Find a Good Business Location.

Can I get a California ID same day?

The CA DMV has created a same day/express service visit option allowing you to bypass the standard waiting lines.

How do I replace my real ID in California?

How to Request a Replacement DL/ID in and office Complete a new DL/ID application. Use our online DL/ID application to apply for a replacement driver's license, ID card, or commercial driver's license. Gather the required proof documents to show DMV. Visit a DMV office to complete the process.

How long do you have to wait to get your driver's license in California?

DL Requirements To obtain a DL, you must: Be at least 16 years old. Have held your instruction permit (in California or another state) for at least 6 months. Provide proof of completion of driver education and driver training.

Can I check the status of my California driver's license online?

This online service provides you with the status of your driver's license or ID card application or renewal. Need to apply for your license?

How long does a California driver's license take to come in the mail?

You will receive your DL via mail within within three to four weeks. If you have not received your DL card after 60 days, visit Driver's License & ID Card Status. Your California DL Application and fee is valid for 12 months after you complete the online application.

How much is a replacement ID in California?

Visit Your Local CA DMV Pay the replacement fee, which is currently $30 as of 2021. Have your photograph validated. Scan your thumbprint. Submit your proof documents (if upgrading to a REAL ID).

How much does it cost to replace a California state ID?

1. How much does it cost? The California Department of Motor Vehicles charges $38 for a Real ID or a regular license. Can I get a Real ID identification card?

How do I get a replacement ID card?

You can apply for a replacement by: Completing Form BI-9 as well if you have not previously submitted your fingerprints. Attaching additional documents as required (e.g. a marriage certificate if you are married) Paying the required fee for the re-issue.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit dl 400d form in Chrome?

Install the pdfFiller Google Chrome Extension to edit dl 400d form and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I edit dl 400d form on an iOS device?

You certainly can. You can quickly edit, distribute, and sign dl 400d form on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Can I edit dl 400d form on an Android device?

You can make any changes to PDF files, such as dl 400d form, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is dmv ol 214?

DMV OL 214 is a form used by the California Department of Motor Vehicles (DMV) to report vehicle ownership transfers for certain transactions.

Who is required to file dmv ol 214?

Individuals who sell or transfer ownership of a vehicle must file DMV OL 214 in order to document the transaction.

How to fill out dmv ol 214?

To fill out DMV OL 214, provide details such as the seller's and buyer's information, vehicle description, and the date of sale on the form.

What is the purpose of dmv ol 214?

The purpose of DMV OL 214 is to officially document the transfer of a vehicle's ownership and ensure that the DMV has accurate records for vehicle registration.

What information must be reported on dmv ol 214?

The information that must be reported on DMV OL 214 includes the names and addresses of the seller and buyer, the vehicle identification number (VIN), the make and model of the vehicle, the date of transaction, and any applicable fees.

Fill out your dl 400d form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dl 400d Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.